For most people, walking into a car dealership can be incredibly stressful. You’re not just choosing a car; you’re navigating the complex and often confusing world of auto financing. This guide is designed to be your roadmap, turning that confusion into confidence by breaking the process down into seven clear, manageable steps.

Whether you’re buying your first car or haven’t secured a loan in years, understanding auto financing doesn’t have to feel overwhelming. By the end of this guide, you’ll know exactly how to secure a fair car loan and avoid costly mistakes that could impact your finances for years to come.

What is Auto Financing and How Does It Work?

Auto financing is simply borrowing money to purchase a vehicle, then paying back that loan over time with interest. Think of it as a partnership between you, a lender (like a bank or credit union), and the car itself, which serves as collateral for the loan.

Here’s how it works in simple terms: A lender gives you money to buy a car, you make monthly payments for an agreed-upon period (typically 3-7 years), and if you can’t make payments, the lender can repossess the vehicle to recover their money. The total amount you pay back will be more than the loan amount due to interest charges.

The key to successful auto financing is understanding this process before you need it, shopping around for the best terms, and knowing exactly what you can afford. Let’s break this down into actionable steps.

Step 1: Check Your Credit Score

Your credit score is the single most important factor that determines your loan terms. Before you even think about car shopping, you need to know where you stand creditwise.

Your credit score affects:

- Loan approval: Whether you’ll qualify for financing at all

- Interest rates: Higher scores get lower rates, saving you thousands

- Loan terms: Better credit often means more flexible payment options

- Down payment requirements: Good credit may require less money upfront

How to check your credit score:

You’re entitled to one free credit report annually from each major bureau through AnnualCreditReport.com. Many banks and credit card companies also provide free credit score monitoring to their customers. For auto financing, most lenders use your FICO score, which ranges from 300-850.

Credit score ranges for auto financing:

- Excellent (750+): Best rates and terms available

- Good (700-749): Competitive rates with most lenders

- Fair (650-699): Higher rates, but financing is still available

- Poor (below 650): Limited options, higher rates, may need a cosigner

If your credit score is lower than you’d like, consider waiting a few months to improve it by paying down existing debts and making all payments on time. Even a 50-point improvement can save you thousands over the life of your loan.

Step 2: Determine Your Budget (How Much Car Can You Afford?)

This step prevents you from falling in love with a car you can’t actually afford. Financial experts recommend following the 20/4/10 rule: put down at least 20%, finance for no more than 4 years, and keep total monthly vehicle expenses under 10% of gross monthly income.

Calculate your maximum monthly payment:

Start with your monthly take-home income and subtract all fixed expenses (rent, utilities, groceries, existing debt payments, savings). What’s left is your discretionary income. Your car payment should be no more than 15-20% of your take-home pay.

Don’t forget these additional costs:

- Insurance (get quotes before buying)

- Registration and taxes

- Maintenance and repairs

- Fuel costs

- Parking fees (if applicable)

The best way to determine your exact budget is with a reliable car loan calculator that factors in your down payment, interest rate, and loan term. This tool will show you exactly how different loan amounts translate to monthly payments, helping you find the sweet spot between the car you want and what you can comfortably afford.

Example calculation:

If you have $3,000 for a down payment and can afford $350 monthly payments, a 5-year loan at 6% APR means you can finance approximately $18,500. Add your down payment, and your total car budget is around $21,500.

Step 3: Get Pre-Approved for a Loan (Your Most Powerful Move)

Pre-approval is your secret weapon in car buying. Walking onto a car lot with a pre-approved loan offer in hand completely changes the conversation. You’re no longer asking “Can you give me a loan?”; you’re telling the dealer “Here is the financing I have. Can you beat it?” This single step puts you in control of the negotiation.

Where to get pre-approved:

- Banks: Often offer competitive rates, especially if you’re an existing customer

- Credit unions: Typically offer the lowest rates and most flexible terms

- Online lenders: Quick applications, competitive rates, fast decisions

- Dealership financing: Convenient but often not the best rates (save this as your comparison point)

The pre-approval process:

- Submit applications to 2-3 different lenders within a 14-day window (this counts as one credit inquiry)

- Provide required documents: proof of income, employment verification, bank statements

- Receive your pre-approval letter with loan amount, interest rate, and terms

- Use this as your negotiating starting point

Benefits of pre-approval:

- Know your budget: Eliminates guesswork about what you can afford

- Negotiate from strength: Dealers know you’re a serious buyer with financing ready

- Compare offers: Gives you a baseline to evaluate dealer financing

- Faster closing: Skip financing delays at the dealership

- Better rates: Lenders compete for your business before you’re emotionally invested in a car

Most pre-approval offers are valid for 30-60 days, giving you plenty of time to shop for the right vehicle.

Step 4: Understand the Key Loan Terms (The “Math” Part)

Understanding these fundamental terms ensures you can evaluate any loan offer and avoid costly mistakes. These numbers directly impact how much you’ll pay over the life of your loan.

APR vs. Interest Rate

The interest rate is the cost of borrowing money, expressed as a percentage. The APR (Annual Percentage Rate) includes the interest rate plus additional fees like origination fees, processing charges, and other loan costs. Always compare APRs, not just interest rates, to get the true cost of the loan.

For example, a loan might have a 5% interest rate but a 5.5% APR once fees are included. The APR gives you the complete picture of what you’re actually paying.

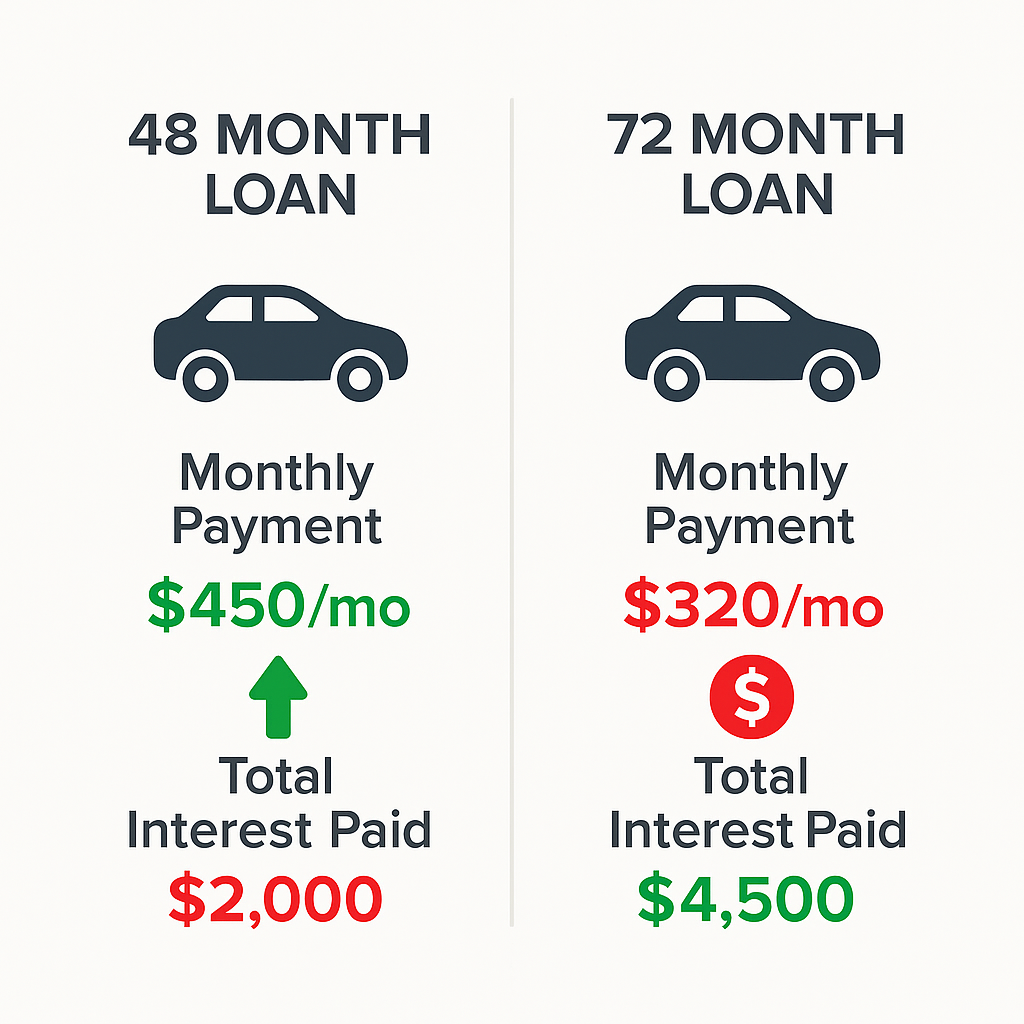

Loan Term (e.g., 36, 48, 60 months)

This is how long you have to repay the loan. Here’s the critical trade-off:

Shorter terms (36-48 months):

- Higher monthly payments

- Less total interest paid

- Build equity faster

- Less risk of being “upside down” (owing more than the car is worth)

Longer terms (60-84 months):

- Lower monthly payments

- More total interest paid

- Higher risk of negative equity

- May outlast the car’s reliable lifespan

Example: A $20,000 loan at 6% APR costs $374/month for 60 months (total: $22,441) versus $456/month for 48 months (total: $21,869). The longer term costs $572 more in interest.

Down Payment

This is money you pay upfront, reducing the amount you need to finance. A larger down payment offers several advantages:

- Lower monthly payments: Less borrowed means smaller payments

- Less interest paid: Interest is calculated on the financed amount

- Easier approval: Shows lenders you have skin in the game

- Immediate equity: Helps prevent being upside down on the loan

- Better rates: Some lenders offer rate discounts for larger down payments

The traditional recommendation is 20% down, but even 10-15% can provide significant benefits. Avoid zero-down loans unless absolutely necessary, as they often come with higher rates and put you at immediate risk of negative equity.

Step 5: Compare Loan Offers

Now comes the strategic part: evaluating your options to find the best overall deal. Don’t just look at monthly payments; focus on the total cost of the loan and terms that fit your financial situation.

Key factors to compare:

- APR: The true cost of borrowing

- Monthly payment: Must fit comfortably in your budget

- Total loan cost: Principal plus all interest over the loan term

- Loan term: Balance between affordable payments and total cost

- Fees: Origination fees, prepayment penalties, late fees

- Flexibility: Options for early payoff, payment deferrals, or modifications

Create a comparison chart:

| Lender | APR | Monthly Payment | Total Cost | Loan Term | Fees |

|---|---|---|---|---|---|

| Bank A | 5.5% | $355 | $21,300 | 60 months | $200 origination |

| Credit Union | 4.9% | $350 | $21,000 | 60 months | No fees |

| Online Lender | 6.2% | $360 | $21,600 | 60 months | $150 processing |

Red flags to avoid:

- Rates significantly higher than your pre-approved offers

- Excessive fees that aren’t clearly explained

- Prepayment penalties that prevent early payoff

- Variable rates that can increase over time

- Loan terms that extend beyond the car’s expected reliable lifespan

Remember, the lowest monthly payment isn’t always the best deal. A slightly higher payment on a shorter term often saves money overall and builds equity faster.

Step 6: Shop for Your Car (With Financing in Hand)

Armed with pre-approval, you can shop like a cash buyer while still getting the benefits of financing. This puts you in the strongest possible negotiating position.

Shopping strategy:

- Focus on the car’s price first: Negotiate the vehicle price before discussing financing

- Don’t mention your pre-approval immediately: Let them present their financing offer first

- Compare the dealer’s offer: They might beat your pre-approved rate

- Be prepared to walk away: Your pre-approval gives you alternatives

Key negotiation points:

- Out-the-door price: Total cost including taxes, fees, and add-ons

- Trade-in value: If applicable, negotiate this separately from the new car price

- Financing terms: Compare the dealer’s offer to your pre-approval

- Extended warranties: Evaluate these separately; they can often be financed

Dealer financing considerations:

Sometimes dealers can beat your pre-approved rate through manufacturer incentives or special programs. They may also offer convenience benefits like handling all paperwork in one location. However, be wary of:

- Marked-up rates: Dealers may increase the rate from what the lender quoted

- Unnecessary add-ons: Extended warranties, service plans, or insurance you don’t need

- Spot delivery: Taking the car before financing is fully approved

Questions to ask the dealer:

- “What rate did the lender actually approve, before any dealer markup?”

- “Can you beat my pre-approved rate of [X]% without add-ons?”

- “What is the out-the-door price with no additional products or services?”

Step 7: Finalize the Loan and Close the Deal

The final step is completing all paperwork and taking possession of your vehicle. This is when attention to detail becomes crucial, as mistakes here can be costly and difficult to fix later.

Documents you’ll need:

- Government-issued photo ID

- Proof of insurance (required before taking possession)

- Proof of income (pay stubs or tax returns)

- Bank statements

- References (if required by lender)

- Down payment (certified check or arranged transfer)

Review all documents carefully:

- Loan agreement: Verify APR, monthly payment, loan term, and total cost match your approved offer

- Truth in Lending disclosure: Federal law requires clear disclosure of all loan terms

- Purchase agreement: Confirm vehicle price, trade-in allowance, taxes, and fees

- Title and registration: Ensure all information is accurate

- Insurance coverage: Verify adequate coverage is in place

Final checklist before signing:

- All numbers match your negotiated terms

- No unauthorized add-ons or services

- Insurance is active and adequate

- You understand all payment terms and due dates

- You have copies of all signed documents

- You know how to make payments and access your account online

After closing:

- Set up automatic payments if desired (many lenders offer rate discounts)

- Save all paperwork in a safe place

- Understand your lender’s payment policies and grace periods

- Consider making extra principal payments to save on interest

Your first payment is typically due 30-45 days after closing. Mark this date on your calendar and understand exactly how and when to make payments to avoid late fees.

Common Auto Financing Mistakes to Avoid

Learning from others’ mistakes can save you thousands of dollars and years of financial stress. Here are the most costly errors first-time car buyers make:

Focusing only on monthly payments: A longer loan term might mean lower payments, but you’ll pay significantly more in total interest. Always calculate the total cost of the loan.

Not getting pre-approved: Shopping without pre-approval puts you at the mercy of dealer financing, often resulting in higher rates and less negotiating power.

Financing the maximum amount you qualify for: Just because you qualify for a $35,000 loan doesn’t mean you should take it. Stick to your predetermined budget based on your actual income and expenses.

Trading in an upside-down loan: If you owe more than your current car is worth, rolling that negative equity into a new loan compounds the problem and puts you deeper underwater.

Not reading the fine print: Prepayment penalties, variable rates, and excessive fees can turn a good deal into an expensive mistake.

Buying unnecessary add-ons: Extended warranties, service contracts, and insurance products sold at closing are often overpriced and unnecessary. You can usually buy these separately for less if you decide you need them.

Not understanding the total cost: Focus on the APR and total amount you’ll pay over the life of the loan, not just the monthly payment.

Financing for too long: Loans longer than 60 months often mean you’ll owe more than the car is worth for most of the loan term, making it difficult to sell or trade the vehicle.

Frequently Asked Questions (FAQ) about Auto Financing

How does financing a car work?

Auto financing is a loan secured by the vehicle you’re purchasing. You borrow money from a lender to buy the car, then repay that amount plus interest over an agreed period. The car serves as collateral, meaning the lender can repossess it if you don’t make payments.

What is the first step in getting a car loan?

Check your credit score and understand your budget. Knowing your credit score helps you anticipate what rates you’ll qualify for, while understanding your budget prevents you from borrowing more than you can afford to repay.

Is it better to get financing from a bank or a dealership?

Generally, banks and credit unions offer better rates than dealerships. However, dealers sometimes have access to manufacturer incentives or special programs that can beat bank rates. The best strategy is to get pre-approved with a bank or credit union, then let the dealer try to beat that offer.

What credit score is needed for auto financing?

You can get auto financing with most credit scores, but the terms vary significantly. Scores above 700 typically qualify for the best rates, while scores below 600 may require higher down payments, shorter terms, or a cosigner.

How much should I put down on a car?

Traditional advice suggests 20% down, but even 10-15% provides significant benefits. A larger down payment reduces monthly payments, total interest paid, and the risk of being upside down on the loan. Avoid zero-down loans unless absolutely necessary.

Can I pay off my car loan early?

Most auto loans allow early payoff without penalty, but verify this before signing. Paying extra toward principal each month or making an occasional extra payment can save hundreds or thousands in interest charges.

What’s the difference between APR and interest rate?

The interest rate is the cost of borrowing money, while APR includes the interest rate plus additional fees like origination charges. Always compare APRs to understand the true cost of differen